The Certificate of Origin (C/O) is an important document to support Vietnamese businesses in benefiting from tariff incentives when importing and exporting. Learn about the different types of C/O, the licensing process in Vietnam, and the steps needed to make the most of the benefits of international trade.

What is a Certificate of Origin (C/O)? Roles and Purposes

Certificate of Origin (C/O) is a certificate of origin of goods issued by the competent authority of the exporting country. The main purpose of C/O is to determine the origin of goods to enjoy international trade preferences, especially in cases where there are preferential tariff policies from bilateral or multilateral trade agreements.

The use of C/O has many important effects. Not only helps goods easily circulate through international markets, but also serves as a basis for verifying the origin of goods, thereby increasing the prestige and quality of products.

Certificate of origin (C/O) issuing agencies in Vietnam

In Vietnam, certificates of origin (C/O) are issued by two main agencies:

Ministry of Industry and Trade

The Ministry of Industry and Trade is the key agency in issuing C/O to businesses. This ministry manages and implements regulations related to the origin of goods to ensure compliance with international standards and protect the interests of enterprises.

Vietnam Chamber of Industry and Commerce (VCCI)

VCCI is also an important organization in the issuance of C/O. This organization inspects the paperwork process to ensure compliance with regulations and supports businesses in complying with the law on the origin of goods.

Certificate of origin (C/O) classification

There are two main types of C/O, including preferential C/O and non-preferential C/O.

Preferential C/O

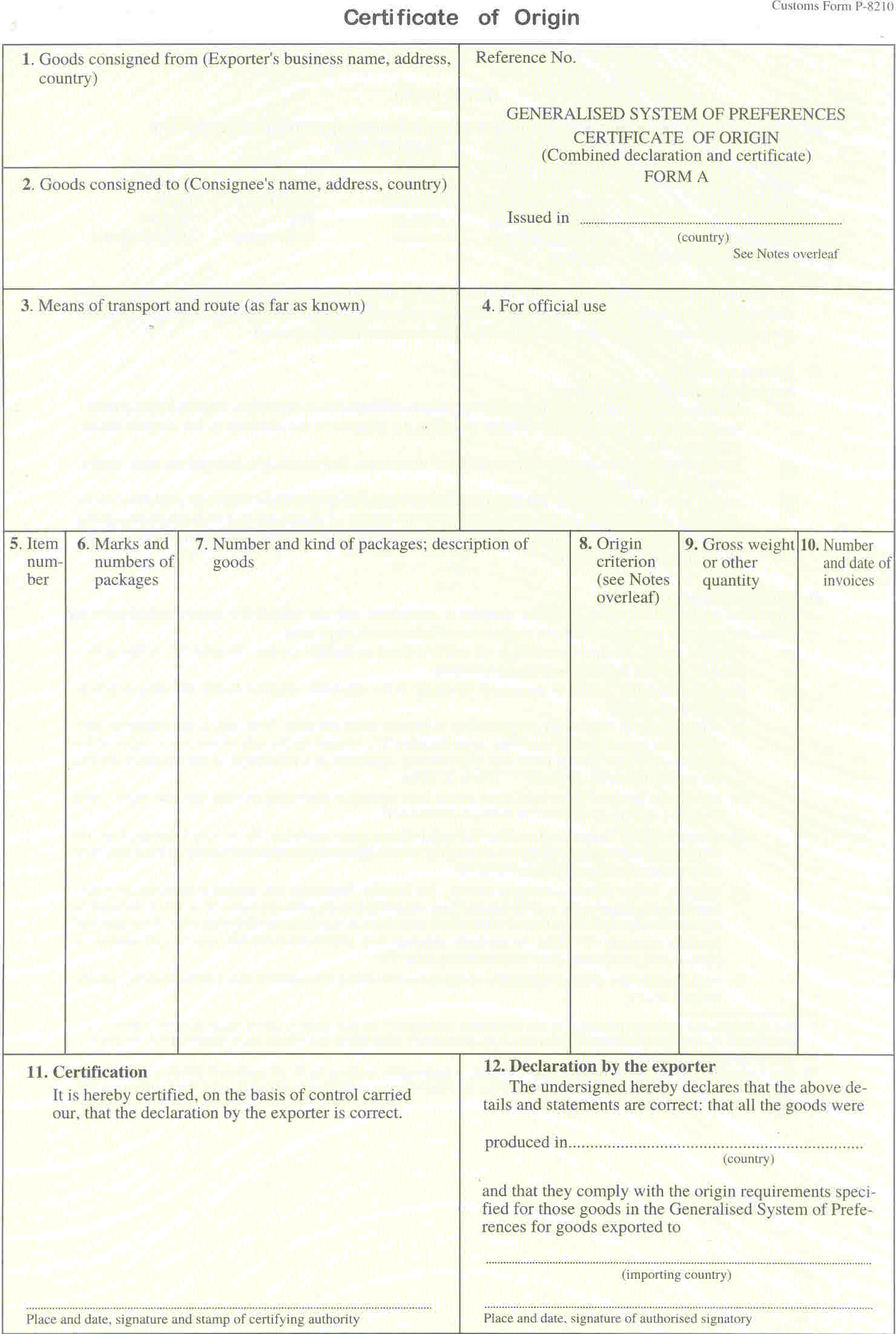

This is a type of C/O that helps businesses reduce taxes when importing into markets that have signed free trade agreements (FTAs) with Vietnam. Popular forms include: Form A: For products exported to the EU entitled to GSP tax incentives. Form D: Applicable to ASEAN countries in the ASEAN Free Trade Agreement (AFTA). Form E: Used for exporting goods to China.

C/O is not preferential

Used to prove the origin of goods but not for the purpose of enjoying tax incentives. Common sample types are:Form B: Applicable to markets that do not require incentives. ICO: For coffee products, issued by the international organization ICO.

Classification of rules of origin supports trade statistics and maintains a quota system: Determining the origin makes it more convenient to compile trade statistics for a country or region. Based on this, trade authorities can maintain the quota system, thereby promoting trade.

In special cases, “non-preferential rules of origin” may become “preferential rules of origin” when goods exported from market X to market Z are subject to safeguard duties or anti-dumping duties that are higher than the normal MFN tariff. Meanwhile, goods from the Y market when imported into the Z market are subject to a lower MFN tax.

Order and procedures for applying for a certificate of origin (C/O)

Steps to take before applying for a C/O

Step 1: Check whether the product is in accordance with the regulations on origin. If not, continue to step 2.

Step 2: Determine the HS code of the exported product (the first 4 or 6 digits of the HS are the basis for determining the origin of the goods).

Step 3: Determine whether the importing country has signed an FTA with Vietnam/ASEAN and/or applied GSP tariff preferences to Vietnam. If yes, skip to step 4.

Step 4: Check whether the exported product is on the list of simple processing stages that do not meet the conditions of origin or not. Otherwise, skip to step 5.

Step 5: Compare tax rates and choose the appropriate C/O form (if any) to apply for issuance, ensuring that goods enjoy the best import tax incentives.

Step 6: Check whether the product complies with the regulations on origin.

C/O issuance procedures

Step 1: Register a Merchant Profile

- When submitting an application for C/O for the first time, the applicant needs to submit the following documents:

- Register the signature sample of the authorized person and the seal of the trader (Appendix I).

- Business registration certificate (certified copy).

- Certificate of registration of tax identification number (certified copy).

- List of production establishments (Appendix II, if any).

- Any changes in the Merchant Profile should be notified immediately to the C/O Issuing Organization for updating. Records need to be updated every two years.

- Traders can only apply for C/O at the place where the dossier has been registered.

- In case you have applied for C/O but have not yet registered, the dossier must be completed within three months from the effective date of the Circular.

Step 2: Receive and check the dossier.

The receiving officer will check the dossier and notify the trader:

- Accept C/O issuance and issuance time.

- Request for additional documents (specify missing documents).

- Request to re-check documents (specify the information to be checked).

- Refuse to issue C/O in accordance with the law.

Step 3: Return the Certificate of Origin (C/O).

Dossier of application for C/O

A dossier of application for C/O comprises:

- The application for C/O has been fully filled out and valid;

- The C/O form consists of one (01) original and three (03) copies. The original and a copy shall be sent by the exporter to the importer for submission at the customs office at the port or place of import. The second copy will be retained by the C/O issuing organization, and the other copy will be kept by the exporter. If requested by the importing country, the C/O applicant may request the C/O-granting organization to issue additional copies of the C/O;

- The export customs declaration has completed customs procedures (a copy signed by a competent person and stamped “true copy of the original”), unless the exported goods do not need to be declared at customs in accordance with law. If there is a plausible reason, the applicant for C/O may submit this document later but not later than thirty (30) days from the date of issuance of the C/O;

The C/O-granting organization may request the applicant to provide additional documents related to the exported product such as the customs declaration of import of raw materials, export license, purchase and sale contract, value-added invoice, sample of raw materials or products, sea bill of lading or not, and other documents to prove the origin of the product;

For enterprises participating in eCOSys, all documents will be signed electronically and automatically sent to the C/O issuing organization. The C/O issuing organization will check the validity of the information on the network dossier and issue a C/O to the trader when the complete paper dossier is received.

C/O issuance time limit

The time limit for issuance of a Certificate of Origin (C/O) must not exceed three working days from the time the applicant submits a complete and valid dossier. If necessary, the C/O issuing organization may inspect at the place of manufacture to ensure that the dossier is eligible for C/O issuance or if there are signs of violation of law in the issued C/O. The inspection result should be made in writing, and this record must be signed by the inspecting officer, the C/O applicant and/or the exporter. If the requester or exporter fails to sign, the inspector shall sign and clearly state the reason. In this case, the time limit for issuance of C/O shall not exceed five working days from the date of submission of a complete dossier. The verification period must not interfere with the delivery or payment of the exporter, unless the cause is caused by the exporter.

This article hopes to bring an overview and details to businesses about the process and benefits of using a Certificate of Origin (C/O). By complying with these regulations, businesses will have the opportunity to optimize costs and expand their international business.

Tiếng Việt

Tiếng Việt 日本語

日本語 中文 (中国)

中文 (中国)