CO form AJ (Certificate of Origin form AJ) is an important document to help businesses enjoy tariff preferences when exporting goods from ASEAN countries to Japan under the ASEAN-Japan Comprehensive Economic Partnership Agreement (AJCEP). Declaring the correct information and applying for the CO form AJ in the right process not only ensures tariff benefits but also helps goods to clear customs conveniently.

In this article, we will learn in detail about the CO form AJ, the purpose of use, the procedures for applying for it and important notes for businesses to prepare fully and accurately.

What is CO form AJ? Purpose of CO form AJ

CO form AJ is a preferential C/O for goods originating from Vietnam when exported to Japan and member countries of the ACCEP multilateral trade agreement.

Goods granted CO form AJ will enjoy incentives when importing and exporting, especially tax incentives. These incentives are based on the Trade in Goods Agreement within the framework of the Comprehensive Economic Cooperation Agreement between the governments of ASEAN countries and Japan.

The countries of this agreement include Japan and ASEAN countries. The CO form AJ is applicable to these countries, including Japan, Vietnam, Laos, Cambodia, Thailand, Indonesia, Singapore, the Philippines, Malaysia and Brunei.

Documents related to the CO form AJ include:

Decision No. 44/2008/QDBCT on the Regulation on the issuance of Certificate of Origin of Goods Form AJ under the ASEAN-Japan Comprehensive Economic Partnership Agreement.

Decree No. 160/2017/NDCP on Vietnam’s special preferential import tariffs implementing the ASEAN-Japan Comprehensive Economic Partnership Agreement for the period of 2018 – 2023.

Procedures for applying for CO form AJ

Application for CO form AJ

To apply for a CO form AJ, businesses need to prepare a complete set of documents, including:

- An application for C/O is made according to the prescribed form.

- CO form AJ has fully declared information (4 originals).

- Commercial Invoice: A copy signed and stamped by the enterprise.

- Bill of Lading or equivalent certificate of delivery.

- Packing list (if any).

- Documents proving the origin of goods: May include:

- Customs declaration.

- Invoices for input materials, sales contracts, and other documents proving that the goods meet the rules of origin.

- Production process (if necessary): Describe in detail the stages to prove the proportion of raw materials produced in ASEAN countries.

CO form AJ issuance process

The process of issuing a CO form AJ takes place in the following steps:

Step 1: Prepare the dossier

- Enterprises gather all necessary documents as required.

- Double-check the information on the documents to avoid errors when submitting documents.

Step 2: Submit the application

- The enterprise submits the dossier at the competent authority (usually the Vietnam Chamber of Commerce and Industry, VCCI or the Ministry of Industry and Trade).

- It can be submitted directly or through the electronic C/O issuance system depending on the regulations of the issuing agency.

Step 3: Review the dossier

- The issuing agency shall check the validity of the dossier and verify information about the origin of the dossier.

- If necessary, the business may be required to provide additional documentation or explanations.

Step 4: Issue CO form AJ

- After the dossier is approved, the issuing agency will print and return the original CO form AJ to the enterprise.

- The enterprise receives the C/O back and stores it in accordance with regulations for use when exporting.

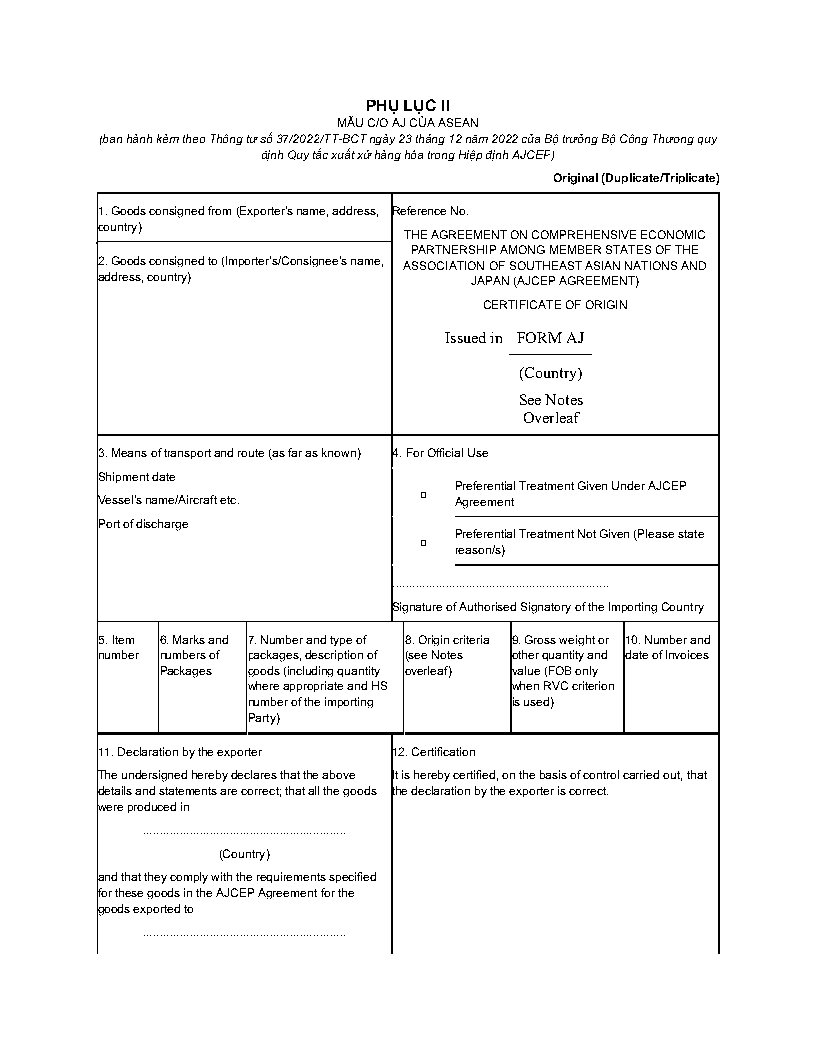

Instructions for declaring C/O form AJ

When filling out the C/O form AJ, you need to pay attention to providing accurate information and must be consistent with the documents in the dossier. Below is a guide on how to declare the items in the C/O form AJ:

Box 1: Write the transaction name of the exporter, address and name of the exporting country (usually Vietnam).

Box 2: Write the consignee’s information including address, name and country of delivery. Top right cell: this section is organized to issue C/O filling. The reference number consists of 13 characters, divided into 5 groups as follows:

- Group 1: “VN” 02 abbreviations of Vietnam.

- Group 2: 02 abbreviations of the name of the importing country, according to the rules: Japan (JP), Thailand (TH), Brunei (BN), Laos (LA), Cambodia (KH), Indonesia (ID), Malaysia (MY), Myanmar (MM), Philippines (PH), Singapore (SG).

- Group 3: 02 characters for the year of C/O issuance.

- Group 4: 02 characters for C/O-issuing organizations, codes prescribed by the Ministry of Trade.

- Group 5: 05 characters for the order number of the C/O Form AJ.

Note: between groups 3, 4, 5 there is a slash to separate.

Box No. 3: This box is for information on the date of departure, the name of the means of transport (if by air, write “By air”, if by sea, write the name of the ship) and the name of the port of loading.

Box No. 4: Leave this box blank, only when importing goods, the customs at the port will mark it appropriately.

Box 5: Fill in the list of goods (item name, shipment, export country, export time).

Box 6: Write the symbol and number of the package.

Box 7: Write the number of packages, the type of package, and the description of the goods (quantity and HS code in the importing country).

Box No. 8: Fill in the following information, based on the country of production indicated in box 11:

- Goods that meet the provisions of Clause 3, Article 2 of Appendix 1: “PE”

- Goods of pure origin under Article 3 of Annex 1: “WO”

- Goods that meet the provisions of Clause 1, Article 4 of Appendix 1: “CTH” or “RVC”

- Goods that meet the provisions of Clause 2, Article 4 of Appendix 1: “CTC”

- Goods with regional value content: “RVC”

- Goods through specific processing and processing: “SP”

- In addition, add the following if appropriate:

- Goods that meet the provisions of Article 6 of Appendix 1: “DMI”

- Goods that meet the provisions of Article 7 of Appendix 1: “ACU”

Box No. 9: Record the weight of the goods both the packaging and the FOB value.

Box 10: Write the date and number of the commercial invoice.

Box No. 11:

- The first line reads “VIETNAM”

- The second line states the name of the importing country

- The third line contains information on the location of C/O issuance, the date of issuance and the signature of the grantor

Cell 12: Leave this cell blank.

- If the C/O is issued later according to the provisions of Clause 4, Article 7 of Appendix V: write “ISSUED RETROACTIVELY”.

- If the C/O is re-issued according to the provisions of Article 8 of Appendix V: write “CERTIFIED TRUE COPY”.

Box 13: Tick the appropriate boxes in case of “ThirdCountry Invoicing”, “Exhibition”, “Back to back C/O”.

Notes when doing C/O form AJ

To ensure the effective application and use of C/O form AJ, businesses need to understand the following important regulations and notes:

1. Time to issue C/O form AJ

According to Article 23 of Circular 37/2022/TTBCT, the C/O form AJ must be issued:

- Before the time of delivery or

- No later than three (03) days from the date of delivery.

Exception: If the C/O is not issued at the time mentioned above, the exporter can apply for a later C/O within 12 months from the date of delivery. In this case, the C/O must be marked (√) in the “Issued Retroactively” Cell.

When using the latter-issued C/O, the importer needs to provide this document to the customs office of the importing country and ensure that the date of delivery is clearly stated in Box 3 of the C/O.

2. Cases of exemption from submitting C/O form AJ

According to Article 22 of Circular 37/2022/TTBCT, C/O form AJ is exempt in the following cases:

- For Japan: Shipments with a customs value of not more than 200,000 Japanese Yen (¥200,000).

- For ASEAN countries: The shipment has an export value not exceeding USD 200 (USD 200).

In case this value changes according to the regulations of the member country, an official notice will be made through the ASEAN Secretariat.

3. Change and correct information on C/O form AJ

It is not allowed to erase or add to the C/O form AJ. All changes must be made in one of the following ways (according to Article 20 of Circular 37/2022/TTBCT):

- Strike out the wrong places and add the necessary information:

- Changes must be approved by the person competent to sign the C/O and certified by the C/O issuing agency.

- The remaining blanks on the C/O must be crossed out to avoid further editing.

- Issue a new replacement C/O: In case it cannot be modified, the enterprise can propose to issue a new C/O to replace the defective C/O.

4. Handling the case of theft, loss or damage of C/O

If the C/O form AJ is stolen, misplaced, or damaged before it expires, the exporter or its authorized person may:

- Request for a new C/O:

- The new C/O has a different reference number and is based on the documents archived at the C/O-issuing agency. The date of issuance and the reference number of the old C/O must be clearly stated in Box 12 (for ASEAN) or Box 9 (for Japan).

- The new C/O is only valid for the validity period of the old C/O.

- Certified Copy Required:

- The issuing authority may provide a certified copy with the phrase “CERTIFIED TRUE COPY” in Box 12 of the copy.

- The copy bears the date of issuance of the original C/O and has the same validity period as the original C/O.

- The time limit for issuance of copies shall not exceed 1 year from the date of issuance of the original C/O.

5. Compliance with legal regulations

The application for and use of C/O form AJ must strictly comply with the legal provisions in Circular 37/2022/TTBCT. In particular, it should be noted that minor errors such as spelling errors or out-of-the-box information may be ignored by the customs authorities, but it is not allowed to distort the authenticity or accuracy of the information on the C/O.

The CO form AJ plays an essential role in supporting businesses exporting goods to Japan to enjoy tariff incentives. Understanding the process and preparing sufficient documents helps businesses save time, optimize costs and ensure commercial interests. Please make sure to update the latest regulations on C/O form AJ from the competent authority, or contact professional logistics companies for advice to avoid errors and achieve the highest efficiency in export activities.

Tiếng Việt

Tiếng Việt 日本語

日本語 中文 (中国)

中文 (中国)