Nowadays, Certificates of Origin (C/O) have become extremely important for businesses operating in the field of import and export, not only domestically but also internationally. Therefore, it is essential to have a clear understanding of the types of C/O forms. HDG Logistics will provide detailed information about the C/O form A and the important factors associated with it in this article.

What is C/O form A?

C/O form A is an important certificate of origin, helping Vietnamese goods enjoy tariff preferences when exported to member countries of the Generalized System of Tariff Preferences (GSP). Understanding the list of countries that accept C/O form A is very important for exporting businesses.

Why is C/O form A important?

- Reduced costs: Goods enjoy tariff incentives, helping to reduce export costs.

- Increase competitiveness: Vietnamese products will have more advantages in the international market.

- Expand your market: Bring your products to more potential markets.

List of countries that accept C/O form A

The list of countries that accept C/O form A may change from time to time, so businesses should keep up to date with the latest information from the competent authorities. However, some typical countries that accept C/O form A include:

- European countries: UK, France, Germany, Italy, Spain, Netherlands, Belgium, Switzerland, Norway, Sweden, Austria, Poland, Hungary, Czech Republic, Slovakia…

- Other countries: Japan, Canada, New Zealand, Russia, Belarus…

Conditions for issuance of C/O form A

To be issued a C/O form A, goods must meet strict rules of origin, specified in trade agreements between Vietnam and importing countries.

Application for C/O form A

To apply for a C/O form A, businesses need to prepare a complete and accurate set of documents. The required documents usually include:

- Application for C/O form A: According to the form prescribed by the certification agency (usually the Vietnam Chamber of Commerce and Industry – VCCI).

- Commercial invoice: Must clearly state information about goods, quantity, unit price, total value, name and address of the exporter and importer.

- Bill of lading packaging: Proof that the goods have been exported.

- Purchase and sale contract: Represents the agreement between the exporter and the importer.

- Quality Certificate: For certain types of goods.

- Other documents: May be required depending on the regulations of each importing country and type of goods.

The time and place of issuance of C/O form A are stipulated as follows: The Vietnam Chamber of Industry and Commerce (VCCI) and the Ministry of Industry and Trade issue it free of charge. Same-day issuance for complete and valid dossiers, however, it may take up to 03 days in some necessary cases. For cases where it is necessary to verify the production and licensing facilities, it may take up to 07 days, and the exporter will be notified of the specific process.

C/O form A application process

The process of applying for a C/O form A (Certificate of Origin Form A) usually includes the following steps:

Step 1: Prepare the dossier

C/O declaration form A: Businesses can download the C/O declaration form A from the website of the Chamber of Commerce and Industry (VCCI) or get it directly at VCCI. The declaration must be completed completely and accurately according to the instructions.

Purchase and sale contract: The contract should clearly state the buyer’s and seller’s information, the name of the goods, the quantity, value, payment terms, and delivery time.

Commercial Invoice: The invoice must fully represent the buyer’s and seller’s information, the name of the goods, the quantity, value, payment terms, and delivery time.

Proof of Transportation: It can be a bill of lading by sea, land, air, or a certificate of cargo insurance.

Quality certification (if needed): Some goods require quality certification to issue a C/O form A, such as food safety certification, certificate of origin, etc.

Step 2: Submit the application

Enterprises can submit applications for C/O form A directly at the Chamber of Commerce and Industry (VCCI) or send them by post.

Step 3: Appraisal of documents by VCCI

VCCI will appraise the application within three working days from the receipt of the application.

In case the dossier is complete and valid, VCCI will issue a C/O form A to the enterprise.

If the dossier is incomplete or invalid, VCCI will notify the reason and request the enterprise to supplement the dossier.

Step 4: Approve and return the dossier

Sign and seal: If the dossier is valid and the goods meet the standards of origin, the C/O issuing agency will sign and stamp the C/O form A.

C/O issuance: After being signed and stamped, the C/O form A will be issued and sent back to the exporter for submission at the customs office of the importing country.

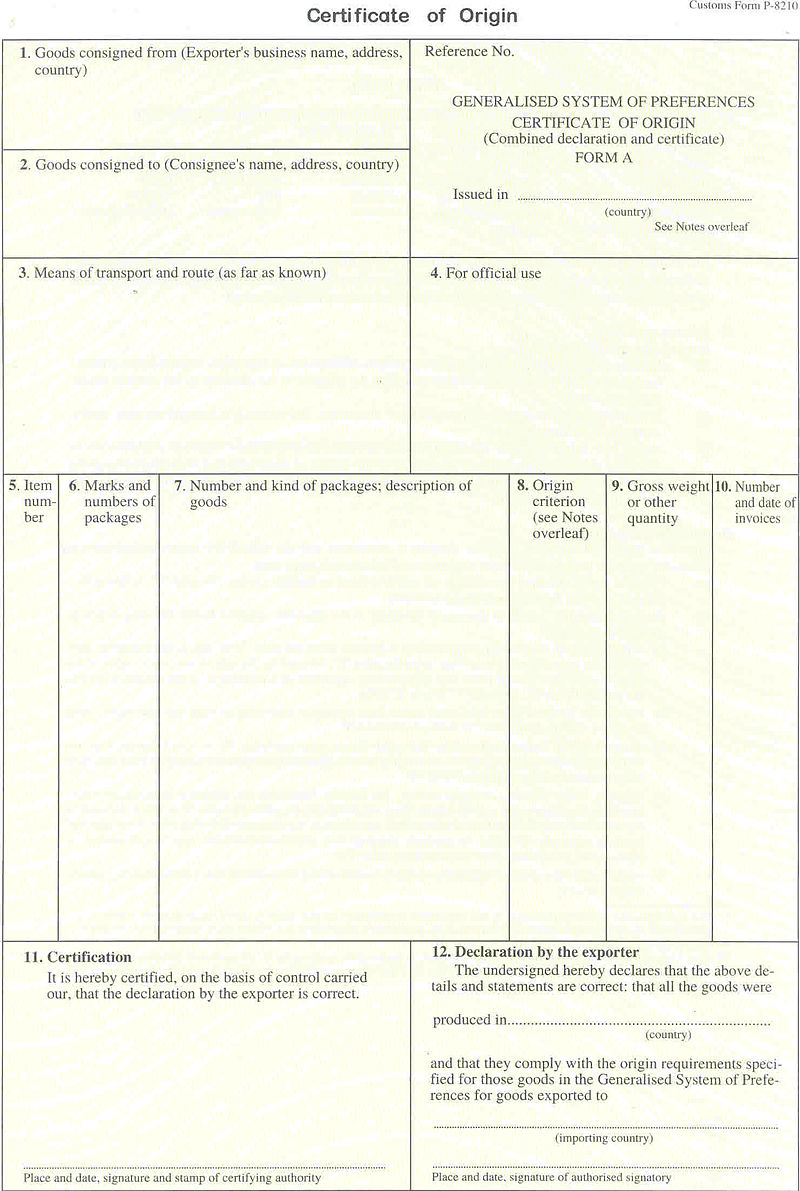

Contents to be declared in C/O form A

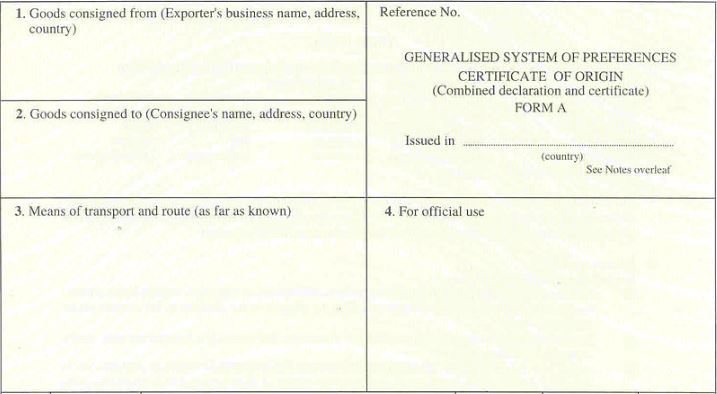

- Box 1: Fill in the information of the Vietnamese exporter in this box, including name, address and country.

- Box 2: This box is for the recipient’s information, including name, address, and country. In case the recipient is designated, the declaration is TO ORDER or TO ORDER OF <designator>. This information must be consistent with the delivery document in the C/O form A dossier.

- Box No. 3: Declare detailed transport information in this box, including the mode of transportation, name of the vehicle, symbol/number of the trip, route of goods (export/import border gate), date and number of the bill of lading. Note that the border gate of receipt and the consignee must be in the same country of import in box 12.

- Box No. 4: This box is for the notes of the C/O issuing agency.

- – C/O issued after the date of shipment: ISSUED RETROSPECTIVELY.

- – Release a copy when the original is lost: THE ORIGINAL OF C/O No. <C/O number> DATED <ISSUE DATE> WAS LOST, DUPLICATE.

- – Replacement C/O when reissued without paying the old C/O: REPLACEMENT C/O No. <old C/O number> DATED <DATE ISSUED>.

- Other notes include notification of exports to ASEAN for production and onward export to the EU, Norway, Turkey, and exports to Japan in accordance with ASEAN GSP regulations, declaration of C-ASEAN, number and date of the combined production and processing certificate.

- Box 5: This is where you list the order numbers of the items in your shipment.

- Box 6: In this box, you need to declare information about the brand and serial number of the box, if any.

- Box 7: You must declare the number and type of boxes in your shipment, including the name and description of the goods.

- Write the exact number and date of the customs declaration for export goods in box 6: CUSTOMS DECLARATION FOR EXPORT COMMODITIES No. <full number of declaration> DATED <date of declaration>.

- If the customs declarant and the shipper are not the same person, you need to write: DECLARED BY <declarant’s name>.

- Specify the date and number of the export licence in box 6: EXPORT LICENCE No.<full number of the licence> DATED <date of the licence>.

- If the container number and lead seal number have been determined, you need to declare them specifically.

- Declare the name and description of the goods accurately and clearly. Do not make general declarations such as GENERAL MERCHANDISE or AND OTHER GOODS.

- Box 8: Here, you declare the standard of origin of the goods. Concrete:

- For goods of pure origin from Vietnam, write the letter “P”.

- For goods of non-pure origin from Vietnam, please follow the instructions in section 3 after the C/O form A.

- Note, for goods exported to Canada originating from more than one country enjoying Canada’s GSP incentives, or goods that only meet Canada’s global aggregate GSP origin regulations, write the letter “G”. In other cases, write the letter “F”.

- Box No. 9: This is a box for declaring information on the gross weight and other quantities of goods. It should be noted that cells 5, 7, 8, 9 must be filled in in line in the order of the item name, standard of origin, gross weight (or other quantity) for each type of goods. In case each type of goods has its own code and is packaged separately, the information on box 6 also needs to be arranged accordingly. If the row name and description of the item are too long, it is possible to continue on the next page, with each page needing to specify the ordinal number in the bottom corner of box 7 (e.g. Page 2 of 3). Once the declaration of the name and description of the goods has been completed, it is necessary to draw a crossed line across boxes 5, 6, 7, 8, 9. Then, specify the total gross weight (or other quantity) of the shipment, in both numbers (TOTAL) and letters (SAY TOTAL).

- Box 10: Write the date and invoice number. In case there is no invoice, it is necessary to specify the reason.

- Box No. 11: It is necessary to declare the place and date of issuance of C/O. The date of submission of the C/O and the time of issuance of the C/O must be accurately declared to reflect the date of issuance of the C/O. The date of issuance of the C/O must not be written on the prescribed working holiday, the date of shipment, etc or any other date if not the actual release date. Unless the month is written in letters (such as April, May, etc.), the date must be written in the format dd/mm/yyyy. The date of issuance of the C/O must be equal to or after the date on which relevant documents have been declared on the C/O such as invoices, customs declarations of export goods, export licenses.

- Box 12: In this box, declare information about the country of origin, e.g. “VIETNAM” after the phrase “produced in”. In addition, if the C/O form A is issued based on the GSP aggregate origin regulations for raw materials in the ASEAN region (according to the regulations of the EU, Switzerland, Norway, Turkey), it is necessary to declare the country of origin according to this regulation. Write the name of the importing country above the line “importing country”. Finally, declare information about the location, date of signing and signature of the competent person (Vietnamese exporter).

Notes when using C/O form A

C/O Form A is a useful tool for Vietnamese exporters to enjoy tariff preferences in many countries. However, to make the most of the benefits of this certification, businesses need to note some of the following points:

- Understand the regulations on origin: Each country applies different standards of origin to issue a Certificate of Origin Form A. Businesses need to thoroughly study these regulations to ensure that their products meet the necessary requirements. Sometimes, products can be considered to be of origin in another country if they are made from ingredients from countries in the same economic bloc. Therefore, mastering the aggregation rule is necessary to make the most of commercial incentives.

- Prepare all necessary documents to apply for C/O Form A, all information on the dossier must be accurate and consistent with other documents.

- Work with the competent authority: Submit the dossier at the Vietnam Chamber of Commerce and Industry (VCCI) or the competent authority, provide full information when requested by the inspection agency.

- C/O Form A regulations may change from time to time. Businesses need to regularly update the latest information to ensure compliance.

- Keep an eye on new markets that can apply tariff incentives for Vietnamese goods.

- If you encounter any difficulties in the process of applying for a C/O Form A, you should look to logistics companies and professional consultants for support.

- Validity period: C/O Form A usually has a certain validity period. Businesses need to pay attention to this deadline to avoid the case of the certificate expiring.

- Risk of fraud: Using a fake C/O Form A or providing false information can lead to serious consequences such as fines or refusal to import goods.

Hopefully, the information in this article will help you grasp the process of issuing a certificate of origin form A (C/O form A). If you have questions about taxes and customs clearance, don’t hesitate to contact HDG Logistics to get the best support.

Tiếng Việt

Tiếng Việt 日本語

日本語 中文 (中国)

中文 (中国)