The Certificate of Origin of CO goods is a very important document in import and export activities. This paper provides information about the origin of the goods, indicating where they were produced or in which country. So what is Co form AK and how to use Co form AK? Join HDG Logistics to find out through the following article.

CO form AK concept

CO stands for “Certificate of Origin”, a certificate of origin issued by exporting countries for domestically produced products. CO needs to comply with the regulations of both exporting and importing countries. There are many different types of CO Form, and the CO Form AK is an important one to keep in mind.

The CO Form AK is issued under the agreement between ASEAN and South Korea. The CO Form AK not only proves the origin of the goods but also helps businesses reduce import taxes, thereby reducing costs and increasing profits significantly.

CO Form AK applies to goods exported to Korea and ASEAN countries that enjoy tax incentives as prescribed. To better understand the content and process of applying for this type of paper, please see the detailed information in the following section.

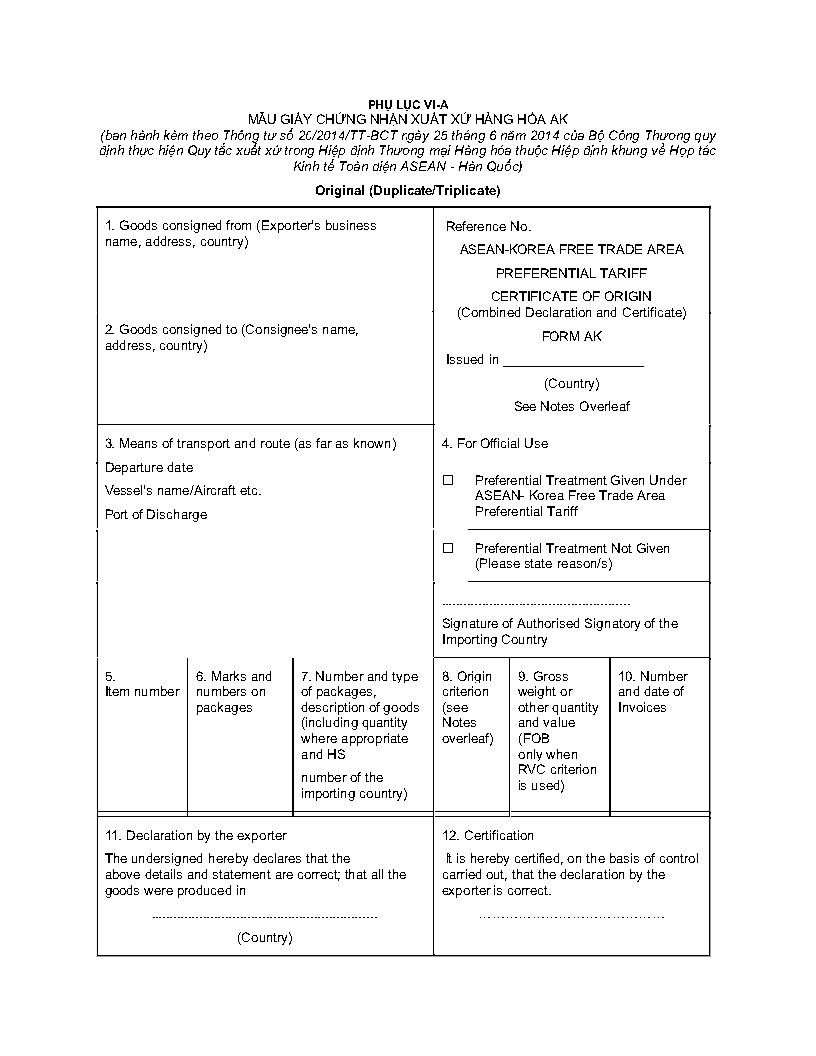

CO form AK sample contents

Before understanding the CO Form AK application process, you need to know what this form includes and what information it shows. Below are the main contents of the CO Form AK:

- Information about sellers and buyers, identical to information on Invoices and Bills.

- Methods and means of transport such as sea, air, or land.

- Whether the goods are entitled to incentives or not will be evaluated by the authorities in the importing country.

- The form also displays basic information such as order number, commodity symbol, quantity, volume, and packaging specifications.

- Criteria for determining the origin of goods.

- The quantity and FOB value of the goods.

- Information about the name of the exporting and importing country, location and date of application for CO.

Instructions for declaring CO form AK

The C/O form AK must be declared in English and printed by a printer or other typewriters (except for the case guided in Clause 15 below). The declared contents must be consistent with the documents specified in this Circular. Specific contents of C/O declaration are as follows:

Box 1: fill in the name and address of the exporter along with the name of the exporting country.

Box 2: fill in the name and address of the consignee along with the name of the importing country.

The top right section is for filling in the reference number (filled in by the C/O issuing organization). The reference number consists of 13 characters, divided into 5 groups, the specific filling is as follows:

- a) Group 1: the code of the exporting country is Vietnam, including 02 characters “VN”;

- b) Group 2: the code of the importing country is the member countries of ASEAN and Korea, including 02 corresponding characters:

| BN: Brunei | MY: Malaysia |

| KH: Cambodia | MM: Myanmar |

| ID: Indonesia | PH: Philippines |

| KR: South Korea | SG: Xingapo |

| LA: Laos | TH: Thailand |

- c) Group 3: Five C/O levels, including 02 characters. For example, a C/O issued in 2014 will be recorded as “14”.

- d) Group 4: Name of the C/O issuing organization, including 02 characters. The list of C/O-granting organizations is specified in Appendix VIII. The Ministry of Industry and Trade will update this list regularly when there is a change in C/O-issuing organizations.

- dd) Group 5: The ordinal number of the C/O, including 05 characters.

- e) Between group 1 and group 2, there is a dash “”. Between group 3, group 4 and group 5 there is a slash “/”.

Example: If the Import and Export Management Department of Hanoi City issues a C/O with the ordinal number of 8 for a shipment exported to Korea in 2014, the reference number of the C/O will be recorded as: VNKR14/01/00008.

- g) In the section “Issued at“, write “VIET NAM“.

Box 3: Write the date of departure and the name of the means of transport; “By air” for aircraft, or ship name and port of discharge for sea.

Box No. 4: The Customs Office at the port or place of import will mark √ in the appropriate box.

Box 5: Write the order number of each item on the C/O; if there are multiple items, each item will have its own order number.

Box 6: Write the symbol and number of the package.

Box 7: Write the number of packages, the type of package, and the description of the goods, including the quantity and HS code of the importing country.

Box 8: Write the origin criteria of the goods.

| Goods manufactured in the country first indicated in box No. 11 of the C/O: | Fill in box 8 |

| (a) Goods of pure origin or wholly produced in the exporting country | “WO” |

| (b) Goods satisfying Clause 1, Article 4 of Appendix I | “CTH” or “RVC 40%” |

| (c) Goods that meet the Item-Specific Rules (Annex II) | |

| Conversion of commodity codes | “CTC” |

| Pure origin or wholly produced in the territory of any member state | “WOAK” |

| Regional Value Content | Write the value content of the area of origin to be achieved (e.g. “RVC 45%”) |

| Area Value Content + Commodity Code Conversion | Write the criteria for combining goods with the origin to be met (e.g. “CTH + RVC 40%”) |

| Specific processing stages | Write “Specific Processes” |

| (d) Goods that satisfy Article 6 of Appendix I | Write “Rule 6” |

Box 9: Write the total weight of the goods (or other quantity) and the FOB value, only applicable when the Regional Value Content (RVC) criterion is used.

Box 10: Write the number and date of issue of the commercial invoice.

Box No. 11:

- The first line: “VIET NAM”.

- Second line: Full name of the importing country, capitalized.

- The third line: Clearly state the location, date, month and year of the request for C/O and the signature of the requester.

Box 12: For employees of the C/O issuing organization to write the date of issuance, signature and seal.

Box No. 13:

- Tick √ box “Third Country Invoicing” if the invoice is issued by a company in a third country that is not a member, or by an exporter on behalf of that company, this information is shown in box 7.

- Tick √ box “BacktoBack CO” if the C/O is issued by the C/O issuing organization of the intermediary country according to Article 7 of Appendix V.

- Mark √ in the “Exhibition” box if the goods are sent from the exporting country of the Member to participate in the exhibition in another country and sold at or after the Exhibition for import into the Member State, according to Article 20 of Appendix V, write the name and address of the exhibition place in Box 2.

Other Instructions:

- If there are many items on the same C/O and there are items that are not eligible for tariff incentives, Customs will tick box No. 4 and that item will be circled or marked in box No. 5.

- Cell 13 can be √ marked with a non-red pen, printer, or typewriter.

Supplementary declaration C/O:

When using the Supplementary Declaration of C/O according to the form in Appendix VIB for many items on one C/O:

- The reference number on the C/O supplementary declaration must be the same as the reference number of the original C/O.

- The cells from 5 to 12 are declared as instructed in items 6 to 13 above. Information in the …

Procedures for applying for CO Form AK

After understanding the main contents of the CO Form AK, you need to carry out the following procedures:

Step 1: Declare business information on the website of the Ministry of Industry and Trade. If there is no certification, prepare a dossier and request a new account.

Step 2: Get the order number and wait to be called at the service counter.

Step 3: Submit the dossier and wait for the receiving officer to check, then there will be detailed advice.

Step 4: Receive the CO and related data from the website after being granted.

Step 5: The receiving officer will sign and approve the CO Form AK, stamp and keep one copy, the other will be returned to the business if the CO is valid.

Notes when declaring CO form AK

According to the provisions of Clause 1, Article 5, Appendix V promulgated together with Circular 20/2014/TT-BCT (Name of the Agreement amended by Article 2 of Circular 04/2024/TT-BCT) amended by Clause 2, Article 1 of Circular 04/2024/TT-BCT, the prescribed CO form AK meets the following conditions:

- Documents of origin (C/O) may be issued in paper form with traditional signatures and seals or in electronic form by C/O-issuing organizations of exporting member countries;

- They are printed on A4 paper;

- They must comply with the form specified in Appendix VIA according to Circular 20/2014/TTBCT, which has been amended according to Article 2 of Circular 04/2024/TTBCT and is known as C/O form AK;

- They must be declared in English.

In addition, a C/O kit includes one original and two carbon copies.

The colors of the originals and carbon copies in a set of C/Os will be agreed upon by the member states. If it is necessary to declare more than one item on one C/O, Member States may use the C/O Supplementary Declaration according to the form specified in Appendix VIB; for ASEAN member states, they can choose to use the Supplementary Declaration C/O or a new C/O.

Organizations that issue CO form AK in Vietnam?

The summary of organizations issuing CO form AK in Vietnam is specified in Appendix VIII issued together with Circular 20/2014/TT-BCT amended by Article 2 of Circular 04/2024/TT-BCT, specifically as follows:

| STT | Unit Name | Code |

| 1 | Hanoi Import and Export Management Department | 01 |

| 2 | Import and Export Management Department of Ho Chi Minh City | 02 |

| 3 | Da Nang Import and Export Management Department | 03 |

| 4 | Dong Nai Import and Export Management Department | 04 |

| 5 | Import and Export Management Department in Hai Phong | 05 |

| 6 | Binh Duong Import and Export Management Department | 06 |

| 7 | Vung Tau Import and Export Management Department | 07 |

| 8 | Import and Export Management Department in Lang Son area | 08 |

| 9 | Quang Ninh Import and Export Management Department | 09 |

| 10 | Lao Cai Import and Export Management Department | 71 |

| 11 | Thai Binh Import and Export Management Department | 72 |

| 12 | Import and Export Management Department in Thanh Hoa area | 73 |

| 13 | Nghe An Import and Export Management Department | 74 |

| 14 | Import and Export Management Department in Tien Giang area | 75 |

| 15 | Import and Export Management Department in Can Tho area | 76 |

| 16 | Import and Export Management Department in Hai Duong area | 77 |

| 17 | Import and Export Management Department of Binh Tri Thien area | 78 |

| 18 | Import and Export Management Department in Khanh Hoa area | 80 |

Cases of refusal to issue a C/O form AK

In fact, there are many cases of refusal to issue a Certificate of Origin (C/O) of the AK form. Most of the reasons are related to the fact that the application does not meet the necessary requirements. Here are some common reasons why an AK C/O application is rejected:

- The applicant for C/O has not registered the trader’s information.

- The application for C/O form AK is incomplete or not in accordance with regulations.

- The applicant for C/O form AK does not submit additional documents missing from the previous application.

- There are signs of fraud on the origin of goods from the previous application for C/O and have not been resolved at the present time.

- The applicant fails to provide sufficient archival documents as prescribed for the C/O issuing agency to conduct inspection later.

- The information in the C/O application dossier is contradictory.

- The AK C/O form is handwritten, using red ink, faded, erased or printed in a variety of ink colors.

- There is clear evidence that the goods applying for C/O do not meet the provisions of the law.

This is information about the C/O form AK that Hai Dang Logistics would like to share. Hopefully, this information will be useful to you in the process of exporting goods abroad.

Tiếng Việt

Tiếng Việt 日本語

日本語 中文 (中国)

中文 (中国)