Are you in the business of exporting to countries such as Russia, Kazakhstan or Belarus? The CO form EAV is an indispensable tool to help your business make the most of the benefits of the Vietnam Free Trade Agreement – Eurasian Economic Union. Let’s learn about the important role of C/O form EAV in promoting the export activities of Vietnamese enterprises.

Overview of CO form EAV

What is the CO form EAV?

C/O form EAV (Certificate of Origin form EAV) is a document certifying the origin of goods exported from Vietnam to countries of the Eurasian Economic Union (EAEU). This paper officially confirms that the product is manufactured or processed in Vietnam and complies with the standards of origin under the Free Trade Agreement between Vietnam and the EAEU.

The Vietnam-EAEU Free Trade Agreement, also known as the Free Trade Agreement between Vietnam and the Eurasian Economic Union, was signed between Vietnam and its member states on May 29, 2015 in Kazakhstan and officially entered into force on October 5, 2016.

Role of CO form EAV

The C/O form EAV is of great importance in the export sector, especially when exporting to EAEU countries. This certificate brings many benefits to businesses, including:

Tax incentives: Goods bearing the C/O form EAV will enjoy preferential import duties, or sometimes tax exemptions in EAEU countries, helping to reduce costs and increase the competitiveness of products.

Confirmation of origin: C/O form EAV certifies the origin of goods, helping businesses avoid trade barriers and anti-dumping investigations.

Increase credibility: Owning a C/O form EAV improves the reputation and image of the business in the international arena, increasing trust from partners and customers.

Purpose of C/O form EAV

The main purposes of the C/O form EAV include:

Proof of origin of goods: Certifying that the goods are manufactured or processed entirely in Vietnam.

Benefit from tariff incentives: Assist businesses in applying tariff incentives based on the Free Trade Agreement between Vietnam and the EAEU.

Export encouragement: Create favorable conditions for businesses to export goods to EAEU markets.

Instructions for declaration and declaration of CO form EAV

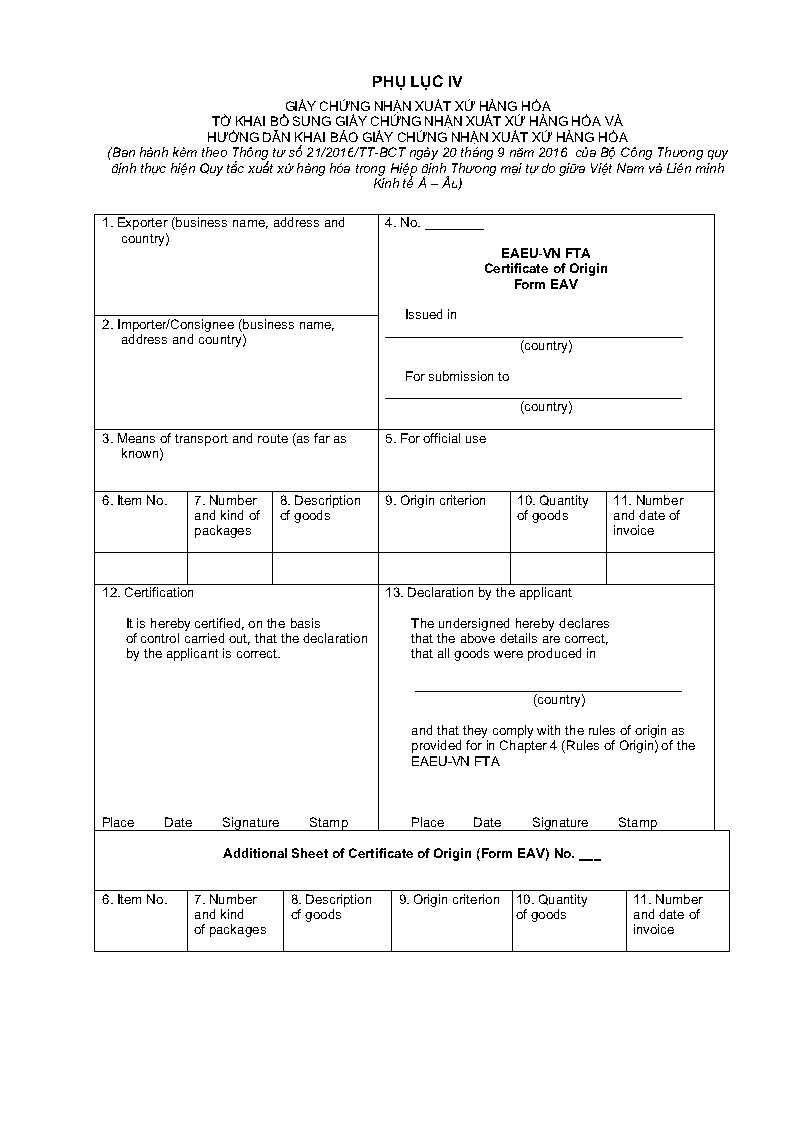

Detailed instructions on the declaration of CO form EAV (Certificate of Origin of goods form EAV) can be found in Appendix IV, issued together with Circular 21/2016/TT-BCT, specifically as follows:

Certificate of Origin (Form EAV) – CO form EAV together with the supplementary declaration must be printed on ISO A4 color paper and comply with the form specified in this Appendix. All information on the certificate of origin must be filled in English.

Unused sections from cell 6 to cell 11 need to be crossed out to prevent further information from being added.

The Certificate of Origin of goods must:

- a) Printed on hard paper and must comply with the form specified in this Appendix, printed in English.

- b) Contain at least necessary information in boxes 1, 2, 4, and 7 to 13;

- c) Signed by a competent person and stamped with the official seal of the authorized agency along with security features. The signature should be handwritten and the seal should not be a copy.

Box 1: In this box, you need to declare the information of the exporter of the goods such as transaction name, address, country, etc.

Box 2: This box is for the information of the importer and consignee, including the transaction name, address, country, etc.

Box 3: This box is for declaring transportation information such as the date of departure (the date the goods are transferred), the means of transport (ship, aircraft, etc.), and the place of unloading (seaport, airport, etc.).

Box 4: This box contains its own reference number, the name of the issuing country and the name of the country receiving the certificate of origin.

Box 5: You need to write “DUPLICATE OF THE CERTIFICATE OF ORIGIN NUMBER___DATE___” if it is a copy of the certificate of origin. If it is a replacement certificate, fill in “ISSUED IN SUBSTITUTION FOR THE CERTIFICATE OF ORIGIN NUMBER___DATE___”. “ISSUED RETROACTIVELY” is used in case the certificate is not issued at the time of export.

Box 6: Information on the order number of the goods.

Box 7: Quantity and type of package.

Box No. 8:

This box is to declare the description of the goods, including the HS code of the importer, model and brand (if any). This information helps to identify specific goods.

If the invoice issued in the third country is not submitted in time for the issuance of the certificate, the number and date of the invoice of the exporter need to be recorded. In addition, if the exported goods are invoiced by a third country for import purposes, this should also be shown.

Include the name and address of the invoice issuer in the third country. In this case, the importer’s customs may require the importer to provide relevant invoices and documents to confirm the transaction.

Box No. 9: In this section, you need to clearly state the criteria for the origin of the goods, specifically as follows:

- Goods originating entirely on one side, complying with Article 4.4 of the WO Agreement.

- Goods are manufactured in one or both parties, using raw materials originating from one or both parties.

- Goods are produced entirely on one side, using raw materials of no origin but meeting specific rules for each type of item.

- Using raw materials without origin but satisfying the requirements of item-specific rules under the PSR Agreement.

Box 10: In this section, you need to declare the number of products, including: total weight (in kilograms) or in other units of measurement such as units, liters, etc. At the same time, clearly state the actual weight of the goods, with a deviation not exceeding 5% compared to the weight stated on the certificate of origin.

Box 11:

This section is intended to contain information about the date of issue and the number of the invoice sent to the authority competent to issue the certificate of origin (C/O). If the invoice is issued by a third country, the information should include: the phrase “TCI”, the name of the company that issued the invoice, and the country in which it operates.

Box No. 12: Write the date of issuance of the certificate of origin, place of issue, signature of the authorized person, enclosed with the seal of the certificate-granting agency.

Box 13: Fill in the origin of the goods (countries of the Eurasian Economic Union or Vietnam), the date of declaration, the place of declaration, the seal and signature of the declarant.

Application for C/O form EAV

Preparing documents to apply for a Certificate of Origin (C/O) for various forms is often quite complicated, because you have to prepare many different documents, and at the same time ensure that the information in the dossier is accurate and consistent. To apply for C/O form EAV, you need to prepare specific documents as follows:

- Application for C/O: Fully declared information and ensure validity.

- C/O form EAV: Fully filled in information together with the C/O supplementary declaration form (if any), based on Appendix V issued together with Circular No. 21/2016/TT-BCT dated 20/9/2016.

- Export customs declaration (hard copy): In case the exported goods are not required to make a customs declaration as prescribed by law, you do not need to submit this document.

- Commercial invoice (copy): Stamped with the original copy of the trader.

- The bill of lading or the corresponding transport document (copy): Stamp the original copy of the trader. In case you do not have a bill of lading, you may be exempted from filing if the exported goods are delivered in the form of goods that do not require a bill of lading or transport document, in accordance with the law.

In addition, if you have not registered a trader profile before exporting goods, you need to register a trader profile. This dossier includes:

- Sample signature and seal of the trader: The signature of the person authorized to sign the C/O application and the seal of the trader must be registered.

- Enterprise registration certificate (copy): Stamped with the original copy.

- List of production establishments of traders.

- An application for change of the place of issuance of C/O (if necessary).

Make sure all documents are carefully prepared so that the C/O application process goes smoothly.

Process of issuance of EAV sample certificate of origin

Once the dossier has been fully prepared to apply for the C/O form EAV, the process of issuing a certificate of origin of goods will be carried out according to the following steps:

Step 1:

Declare the first-time trader registration dossier to the Ministry of Industry and Trade or submit it directly at the head office of the C/O issuing organization.

Step 2:

Submit the application for C/O through the following methods:

- Online at the www.ecosys.gov.vn

- Directly at the head office of the C/O issuing organization where the trader’s dossier has been registered.

- Mail if travel is difficult.

Step 3: The

C/O issuing organization will check the validity and accuracy of the dossier, then respond with one of the following contents:

- C/O acceptance: Notification of the time to receive the certificate.

- Request for additional documents: A specific list of documents to be supplemented will be provided.

- Request to re-examine the dossier: Clearly state the information or content to be checked, enclosed with the grounds for authentication.

- Refusal to issue C/O: In case of detecting errors as prescribed in Article 21 of Decree No. 31/2018/ND-CP dated 08/3/2018 on management of origin of goods.

- Request for inspection of production facilities: Carry out in case of necessity.

Properly following the above process will help you get C/O quickly and efficiently.

List of organizations that issue CO form EAV in Vietnam?

The list of organizations issuing CO form EAV of Vietnam is specified in Appendix V issued together with Circular 21/2016/TT-BCT, specifically as follows:

| STT | Unit Name | Code |

| 1 | Hanoi Import and Export Management Department | 01 |

| 2 | Import and Export Management Department of Ho Chi Minh City | 02 |

| 3 | Da Nang Import and Export Management Department | 03 |

| 4 | Dong Nai Import and Export Management Department | 04 |

| 5 | Import and Export Management Department in Hai Phong | 05 |

| 6 | Binh Duong Import and Export Management Department | 06 |

| 7 | Vung Tau Import and Export Management Department | 07 |

| 8 | Import and Export Management Department in Lang Son area | 08 |

| 9 | Quang Ninh Import and Export Management Department | 09 |

| 10 | Lao Cai Import and Export Management Department | 71 |

| 11 | Thai Binh Import and Export Management Department | 72 |

| 12 | Import and Export Management Department in Thanh Hoa area | 73 |

| 13 | Nghe An Import and Export Management Department | 74 |

| 14 | Import and Export Management Department in Tien Giang area | 75 |

| 15 | Import and Export Management Department in Can Tho area | 76 |

| 16 | Import and Export Management Department in Hai Duong area | 77 |

| 17 | Import and Export Management Department of Binh Tri Thien area | 78 |

| 18 | Khanh Hoa Import and Export Management Department | 80 |

| 19 | Ha Tinh Import and Export Management Department | 85 |

| 20 | Ninh Binh Import and Export Management Department | 86 |

| 21 | Management Board of Hanoi Industrial and Export Processing Parks | 31 |

Through this article, we have learned about the CO form EAV and its importance for exports. It is hoped that the information provided will help Vietnamese exporters gain more knowledge and confidence in the process of exploiting the market of the Eurasian Economic Union.

Tiếng Việt

Tiếng Việt 日本語

日本語 中文 (中国)

中文 (中国)