In the current market, goods trade between Japan and Vietnam accounts for a significant market share. Import-export enterprises into the Japanese market are particularly interested in C/O to enjoy preferential import tariffs. To take advantage of the best tax incentives, what C/O form do businesses need to declare? If you are interested in C/O, follow HDG Logistics’ article below, instructions on how to declare CO form VJ to enjoy the most preferential import tax rate from Japan.

What is CO form VJ? What is the purpose of using C/O form VJ?

CO form VJ is a certificate of origin of goods, applicable to goods from Vietnam or Japan. CO form VJ is issued by the Import and Export Management Department based on the Free Trade Agreement (FTA) between the two countries. Vietnam and Japan maintain the Most Favored Nation (MNF) relationship and jointly participate in the Vietnam-Japan Economic Partnership Agreement (VJEPA) and the ASEAN-Japan Comprehensive Economic Partnership Agreement (VJCEP). Therefore, goods between the two countries, if they have a valid CO form VJ, will enjoy preferential import tax rates, which can be up to 0% depending on the type of goods. This helps businesses strengthen their competitive advantage in the market.

See more: How to declare CO form VJ information – HDG Logistics

Detailed instructions for declaring CO form VJ.

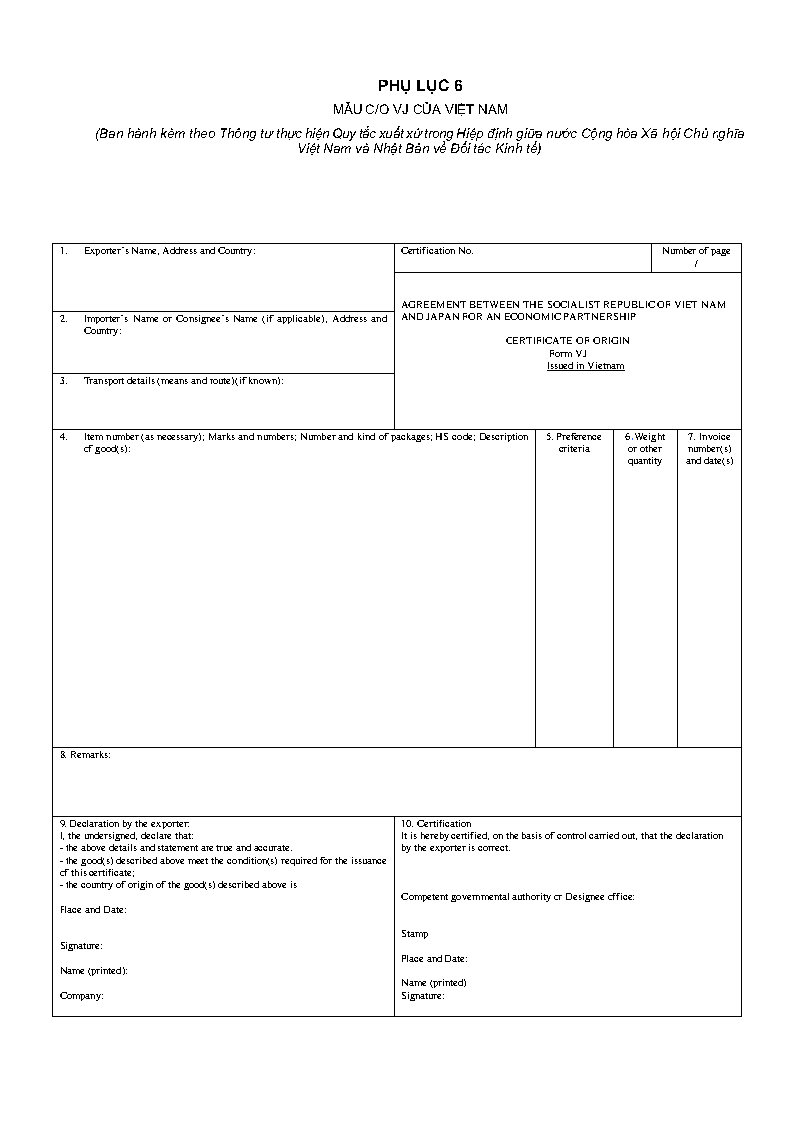

Instructions for declaration of Certificate of Origin of goods form VJ (CO form VJ) are detailed in Appendix 8 issued together with Circular 10/2009/TT-BCT:

The C/O must be declared in English and typed. The declaration must be consistent with the documents specified in Articles 5 and 6 of Circular No. 10/2009/TT-BCT: The specific contents of the C/O declaration are as follows:

(1) Box No. 1: Transaction name of the exporter, address, name of the exporting country.

(2) Box No. 2: Name of the importer or consignee (if any), address, name of the importing country.

(3) Top right box: Reference number recorded by the C/O issuing organization. The reference number consists of 13 characters, divided into 5 groups, and is written as follows:

– Group 1: The name of the exporting member country is Vietnam, including 02 characters “VN”;

– Group 2: The name of the importing member country is Japan, consisting of 02 characters “JP”;

– Group 3: Five C/O levels, including 02 characters. Example: In 2009, it will be written as “09”;

– Group 4: Abbreviation of the C/O-issuing organization, including 02 characters as prescribed in Appendix 11;

– Group 5: The ordinal number of the C/O, consisting of 05 characters;

– Between group 1 and group 2 there is a dash “-“. Between group 3, group 4 and group 5 there is a slash “/”.

Example: The C/O reference number issued by the Import and Export Administration of Ho Chi Minh City for the 6th shipment exported to Japan in 2009 will be: VN-JP/09/02/00006.

(4) Box 3: Specify the name of the loading port, transshipment port, and unloading port, along with the name of the ship or flight number if any. For C/O issued later, it is necessary to write the exact date of delivery as on the bill of lading.

(5) Box 4: Write the order number of each item if necessary, the symbol and code number of the package, the number of packages, the type of package, the HS code (2007) of the importing country in 6 digits and a detailed description of the goods.

(6) Box 5: Write the criteria of origin according to the following table or a combination of criteria if necessary:

| Goods manufactured in the country first indicated in box No. 9 of the C/O: | Fill in box 5: |

| a) Goods of pure origin according to Article 3 of Appendix 1 | “WO” |

| b) Goods that satisfy the provisions of Clause 1, Article 4 of Appendix 1 | “CTH” or “LVC” |

| c) Goods that meet the provisions of Clause 2, Article 4 of Appendix 1

– Change the commodity code – Regional value content – Specific processing stages |

“CTC”

“LVC” “SP” |

| d) Goods that satisfy the provisions of Clause 3, Article 2 of Appendix 1 | “PE” |

| In addition, the exporter shall also write the following appropriate criteria: | |

| dd) Goods that meet the provisions of Article 6 of Appendix 1 | “DMI” |

| e) Goods that meet the provisions of Article 7 of Appendix 1 | “ACU” |

| g) Goods that meet the provisions of Article 13 of Appendix 1 | “IIM” |

(7) Box 6: Write the weight or other quantity (including the whole weight and net weight) for each type of goods.

(8) Box No. 7: Write the number and date of the commercial invoice, which must be issued for the shipment of goods imported into the importing member country.

In case the invoice is issued by a company that is not an exporter and is not based in Vietnam or Japan, the declarant should clearly state in box 8 that the invoice is issued by a third country, accompanied by the legal transaction name and address of the issuing company.

If the number of the commercial invoice issued by the third country is not known at the time of issuance of the C/O, the number and date of the invoice issued by the exporter will be recorded in box 7. In box 8, it is necessary to specify that the goods will have another invoice issued by a third country, and specify the name of the legal transaction and the address of the company that will issue the invoice.

In this case, the customs office of the importing member state may request the importer to provide invoices and other relevant documents to confirm the transaction between the exporting and importing member countries for imported goods.

(9) Box 8: If the C/O is issued later, the C/O issuing organization needs to write “Issued Retroactively” on this box. If the C/O is newly issued under Article 4, Clause 2, Point b and Article 5, Clause 1 of Appendix 5, the C/O-granting organization shall write the date of issuance and the reference number of the original C/O on the new C/O.

If issuing a certified copy from the original C/O according to Article 5, Clause 2 of Appendix 5, the C/O issuing organization needs to write “CERTIFIED TRUE COPY” on box No. 8. The C/O issuing organization may also write other notes.

(10) Box 9: Write the date, place, name of the signatory, company name, signature and seal of the exporter or authorized person. The date of writing is the date of application for C/O.

(11) Box No. 10: used by the officer of the C/O-granting organization to record: date, month and year of issuance of the C/O, place of issuance, signature of the C/O-issuing officer (which can be a manual or electronic signature), name of the C/O-issuing officer, and stamped with the seal of the C/O-issuing organization.

Procedures for applying for CO form VJ

Application for CO form VJ

To apply for a CO form VJ, businesses need to prepare a complete set of documents, including:

- An application for C/O is made according to the prescribed form.

- The CO form VJ has fully declared information (4 originals).

- Commercial Invoice: A copy signed and stamped by the enterprise.

- Bill of Lading or equivalent certificate of delivery.

- Packing list (if any).

- Documents proving the origin of goods: May include:

- Customs declaration.

- Invoices for input materials, sales contracts, and other documents proving that the goods meet the rules of origin.

- Production process (if necessary): Describe in detail the stages to prove the proportion of raw materials produced in ASEAN countries.

CO form VJ issuance process

The process of issuing a CO form VJ takes place in the following steps:

Step 1: Prepare the dossier

- Enterprises gather all necessary documents as required.

- Double-check the information on the documents to avoid errors when submitting documents.

Step 2: Submit the application

- The enterprise submits the dossier at the competent authority (usually the Vietnam Chamber of Commerce and Industry, VCCI or the Ministry of Industry and Trade).

- It can be submitted directly or through the electronic C/O issuance system depending on the regulations of the issuing agency.

Step 3: Review the dossier

- The issuing agency shall check the validity of the dossier and verify information about the origin of the dossier.

- If necessary, the business may be required to provide additional documentation or explanations.

Step 4: Issue CO form VJ

- After the dossier is approved, the issuing agency will print and return the original CO form VJ to the enterprise.

- The enterprise receives the C/O back and stores it in accordance with regulations for use when exporting.

Time to issue CO form VJ

The time limit for issuance of Certificate of Origin (C/O) of VJ form shall not exceed three (03) working days from the date the applicant submits a complete and valid dossier, according to Clauses 1 and 2, Article 8 of Circular No. 10/2009/TT-BCT.

– If the examination of the dossier is not sufficient basis for granting the C/O, or if there are signs of violation of law in the issued C/O, the C/O issuing organization has the right to conduct the inspection at the place of manufacture.

+ The inspecting officer of the C/O issuing organization shall make a record of the inspection result and request the C/O applicant and/or the exporter to sign the record.

+ If the C/O applicant and/or the exporter refuses to sign, the inspector shall clearly record the reason for refusal and sign the certification in the record.

+ In this case, the time limit for issuance of C/O shall not exceed five (05) working days from the date the applicant submits a complete dossier.

Above is information about the CO form VJ procedure that hdglog would like to share with you. If you need to learn more about this procedure or are looking for reputable and fast freight forwarders, please contact us to receive timely advice and support.

Tiếng Việt

Tiếng Việt 日本語

日本語 中文 (中国)

中文 (中国)