Induction cooktops have become a familiar appliance in many Vietnamese households. So, what are the procedures for importing induction cooktops? What documents are required? What is the import process? HDG Logistics will answer all your questions in the detailed article below.

Legal Regulations on Importing Induction Cooktops

Induction cooktops are subject to specialized management by the Ministry of Science and Technology, so businesses need to conduct quality inspections after customs clearance according to Decision No. 2711/QD-BKHCN. However, importing induction cooktops does not require a specialized permit as this product is not on the list of prohibited imports or exports under Decree No. 69/2018/ND-CP. Additionally, businesses must ensure the products comply with the national technical regulations on electromagnetic compatibility for household electrical and electronic appliances and similar purposes according to Circular No. 07/2018/BKHCN.

HS Code and Import Tariff for Induction Cooktops

HS Code for Induction Cooktops

Induction cooktops have an HS code under Chapter 85 in the export-import tariff schedule: Electrical machinery and equipment and parts thereof; sound recorders and reproducers, television image and sound recorders and reproducers, and parts and accessories of such articles. Specifically:

85.16: Electric instantaneous or storage water heaters and immersion heaters; electric space heating apparatus and soil heating apparatus; electro-thermic hairdressing apparatus (for example, hair dryers, hair curlers, curling tong heaters) and hand dryers; electric smoothing irons; other electro-thermic appliances of a kind used for domestic purposes; electric heating resistors, other than those of heading 85.45.

8516.60: Other ovens; cookers, cooking plates, boiling rings, grillers, and roasters:

8516.60.90: Other

Import Tariffs for Induction Cooktops

The import tariffs for induction cooktops into Vietnam are as follows:

- Preferential Import Duty: 20% (general application)

- Special Preferential Rates:

- From China: 0% (condition: C/O Form E)

- From Japan: 4% (condition: C/O Form AJ)

- From Europe (countries under EVFTA): 10%

- Value-Added Tax (VAT): 8%

Import Procedures for Induction Cooktops

Required Customs Documents for Importing Induction Cooktops

The import customs documents for induction cooktops, similar to other goods, are specified in Circular 38/2015/TT-BTC dated March 25, 2015, and amended by Circular 39/2018/TT-BTC dated April 20, 2018. Specifically, the import dossier includes:

- Customs declaration form

- Commercial invoice

- Bill of lading

- Packing list

- Sales contract

- Quality inspection registration documents

- Certificate of Origin (C/O) (if available)

- Catalog (if available)

Businesses must prepare these documents accurately and completely to ensure a smooth and efficient import process.

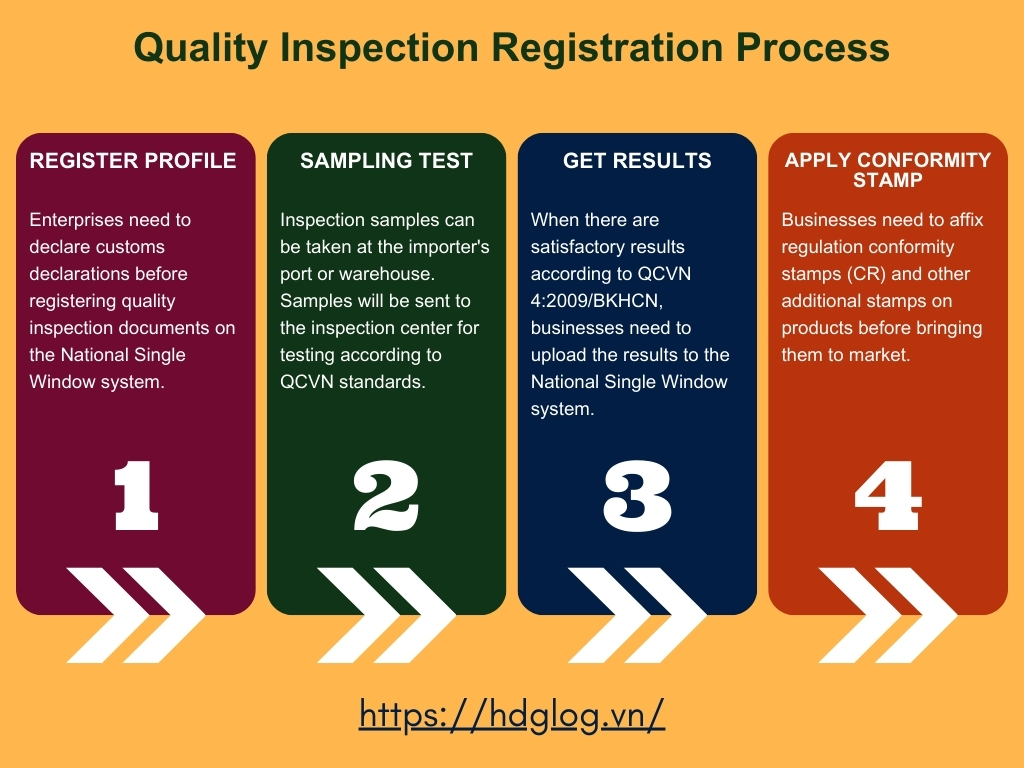

Quality Inspection Registration for Induction Cooktops

Electric cooktops operate using mains electricity. When conducting import procedures, businesses must perform quality inspections on imported induction cooktops. Below is the registration process for quality inspection of imported goods.

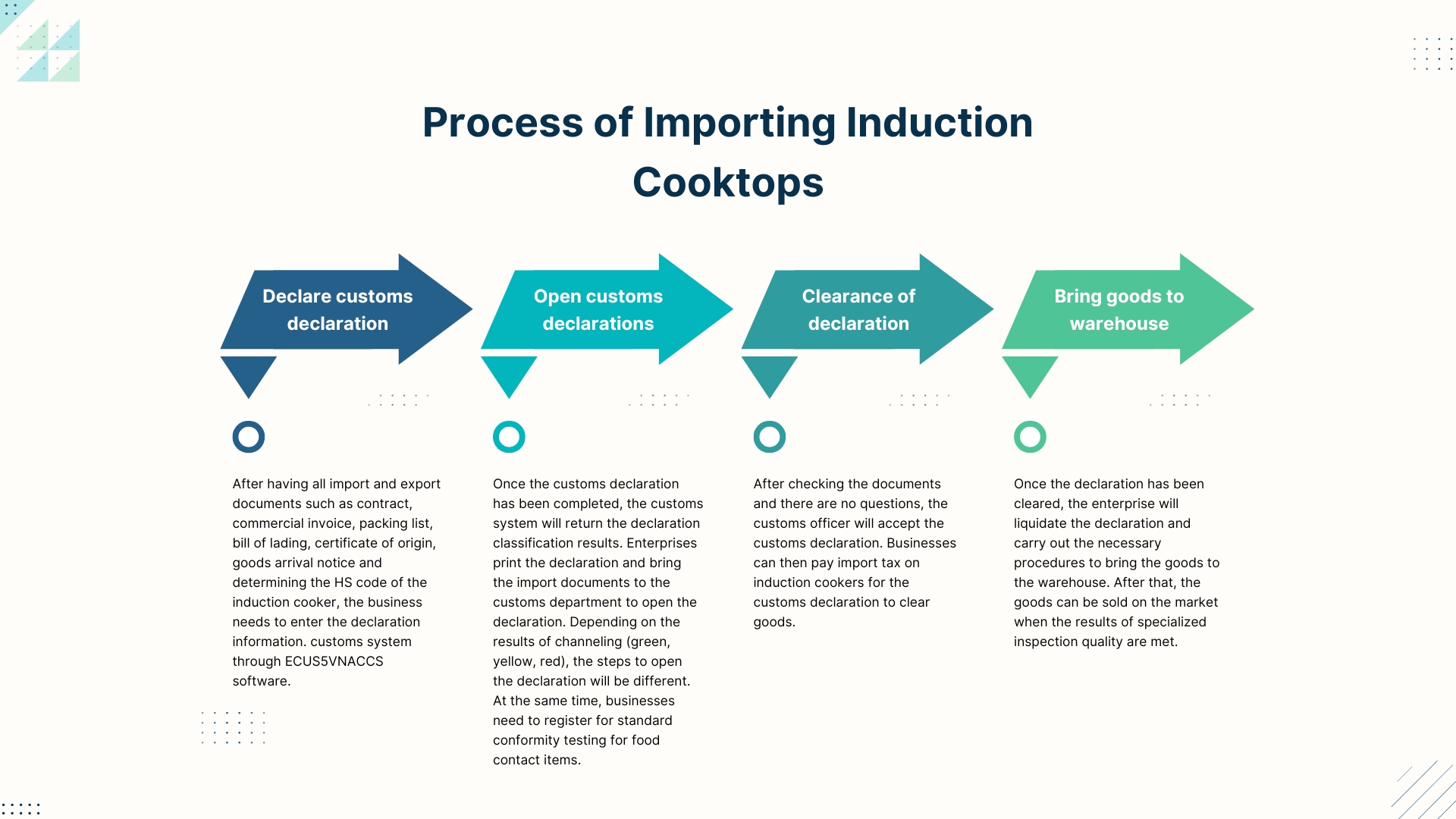

Import Procedures for Induction Cooktops into Vietnam

The import procedures for induction cooktops and other items are specified in Circular 38/2015/TT-BTC dated March 25, 2015, amended by Circular 39/2018/TT-BTC dated April 20, 2018. Below is a brief description of the main steps in this process.

HDG Logistics hopes this detailed guide on the import procedures for induction cooktops is helpful. Depending on specific cases, there may be different handling methods. If customers have any questions related to procedures and customs, please contact HDG Logistics for detailed guidance.

HAI DANG GLOBAL LOGISTICS COMPANY LIMITED (HDG Logistics)

Hanoi: Floor 5, 29 Company Building, 73 Nguyen Trai Str., Thanh Xuan Dist., Ha Noi City, Vietnam.

☎Hotline: (024) 3207 6996

HCM: Floor 2, WASECO Building, 10 Pho Quang Str., Ward 2, Tan Binh Dist., HCM City, Vietnam.

☎Hotline: (028) 6251 9969

Haiphong: 4.2, Floor 4, Khanh Hoi Building, Le Hong Phong Str., Ngo Quyen Dist., Hai Phong City, Vietnam.

☎Hotline: (0225) 3559 088

Hanam: 380 Vuc Vong Str., Dong Van Ward, Duy Tien Town, Ha Nam Province, Vietnam

Tiếng Việt

Tiếng Việt 日本語

日本語 中文 (中国)

中文 (中国)